Referral Code and share market, Upstox, INDmoney,Coin, HDFC, Edelweiss,Zerodha, Dainik

Share market is where buying and selling of share happens. Share represents a unit of ownership of the company from where you bought it. For example, you bought 10 shares of Rs. 200 each of ABC company, then you become a shareholder of ABC.

Types Of Share Markets

Stock markets can be further classified into two parts:

primary markets and secondary markets.

1. Primary Share Markets

When a company registers itself for the first time at the stock exchange to raise funds through shares, it enters the primary market. This is called an Initial Public Offering (IPO), after which the company becomes publicly registered and its shares can be traded within market participants.

2. Secondary Market

Once a company’s new securities have been sold in the primary market, they are then traded on the secondary stock market. Here, investors get the opportunity to buy and sell the shares among themselves at the prevailing market prices. Typically investors conduct these transactions through a broker or other such intermediary who can facilitate this process.

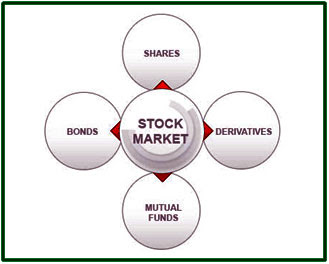

What Is Traded On The Share Market?

There are four categories of financial instruments that are traded on the stock exchange. These include:

1. Shares

A share represents a unit of equity ownership in a company. Shareholders are entitled to any profits that the company may earn in the form of dividends. They are also the bearers of any losses that the company may face.

2. Bonds

To undertake long term and profitable projects, a company requires substantial capital. One way to raise capital is to issue bonds to the public. These bonds represent a “loan” taken by the company. The bondholders become the creditors of the company and receive timely interest payments in the form of coupons. From the perspective of the bondholders, these bonds act as fixed income instruments, where they receive interest on their investment as well as their invested amount at the end of the prescribed period.

3. Mutual Funds

Mutual funds are professionally managed funds that pool the money of numerous investors and invest the collective capital into various financial securities. You can find mutual funds for a variety of financial instruments like equity, debt, or hybrid funds, to name a few. Each mutual fund scheme issues units that are of a certain value similar to a share. When you invest in such funds, you become a unit-holder in that mutual fund scheme. When instruments that are part of that mutual fund scheme earn revenue over time, the unit-holder receives that revenue reflected as the net asset value of the fund or in the form of dividend payouts.

4. Derivatives

A derivative is a security that derives its value from an underlying security. This can have a wide variety such as shares, bonds, currency, commodities and more! The buyers and sellers of derivatives have opposing expectations of the price of an asset, and hence, enter into a “betting contract” with regards to its future price.

WHAT DOES THE SEBI DO?

Its basic objectives are:

1. Protecting the interests of investors in stocks

2 Promoting the development of the stock market

3. Regulating the stock market

What is a referral program?

A referral program is a marketing tactic that encourages your existing customers to share your brand with their friends, colleagues, and family members. In exchange for their effort, a referral program usually offers customers a reward, such as a gift card, discount, points, or swag.

The beauty of a referral program is it helps businesses easily pinpoint their biggest brand fans, as well as track exactly where their new customers are coming from. A formalized program also makes it easy for customers to share your brand, with a dedicated referral page and messaging.

1. Standardizes the sharing process.

2. Attracts new customers at a very low cost.

Here are a few applications that work very well:

2. CoinSwitch Kuber is a cryptocurrency exchange platform. CoinSwitch Kuber is a secure, user friendly platform for users in India, where they can buy 100+ cryptocurrencies like Bitcoin, Ethereum, Ripple, etc easily, at the best rate, with a variety of payment options being offered. The users can access the pooled liquidity of the leading exchangesin India to get the best rate and trade instantaneously, after completing the KYC/AML procedures. CoinSwitch Kuber app is the best cryptocurrency trading platform by providing you with a seamless user experience, through a simplistic user interface.

Link to get the app

Hey, get FREE BITCOIN worth Rs. 50 on downloading the CoinSwitch Kuber app using my referral link. Join me and 1.4 crore traders who are trading in 100s of crypto. Hurry, use my link:

https://coinswitch.co/in/refer?tag=UwSLr

2.1. CoinDCX is an India-based crypto trading and exchange organisation co-founded by CEO Sumit Gupta. The organisation has two applications like CoinDCX Go and CoinDCX Pro. Both the applications are two of the most important apps for investors and traders looking for crypto investments and exchange. However, recently many CoinDCX users are wondering about the difference between CoinDCX Pro and CoinDCX Go. If you have been wondering about CoinDCX vs CoinDCX Go too, then do not worry, here is all you need to know about it.

CoinDCX vs CoinDCX Go

Both CoinDCX Pro and CoinDCX Go are almost the same, but a bit different from one another in various functionalities. The CoinDCX Go app is a cryptocurrency investment application with 500k downloads, whereas the CoinDCX Pro app is a Cryptocurrency Exchange application with 100k downloads.

Get Your link here

3. HDFC securities provides a seamless online real-time platform to trade and track your stocks, with a smart all inclusive portfolio. You can Buy or Sell stocks on both the BSE and the NSE. To trade you can use any of online trading platform, Mobile App or simply Call N Trade.

Link to get the app

4. Edelweiss.in is one of India's leading diversified investment destinations, which helps you trade in stock market and make investments across multiple asset classes like Equity, F&O, Currency Derivatives, Mutual Funds and Fixed Income products.

Link to get the app

https://edelweissreferral.ref-r.com/c/i/23306/64115857

5. Vauld, With a host of financial products, Vauld is a full-suite crypto platform. Users can lock their cryptos into fixed deposits at up to 12.68% interest. ... Vauld supports trading in the stablecoin USDT and in the Indian rupee (INR) trading pair, the fastest growing trading pair among fiat currencies.

Link to get the app

https://www.vauld.com/register/cnnp5k

Or use code "cnnp5k"

6. Zerodha is India's largest stock broker. It is among the best and cheapest brokers in India. Zerodha offers discount stock and commodity trading at flat Rs 20 per executed order irrespective of the size of the order. The equity delivery trades and Mutual Fund investment are brokerage free.

Link to get the app

Comments

Post a Comment